The Census Bureau note, Many U.S. Households Do Not Have Biggest Contributors to Wealth: Home Equity and Retirement Accounts by Jonathan Eggleston and Donald Hays (8/27/19), highlights gaps in wealth by household type.

The Census Bureau note, Many U.S. Households Do Not Have Biggest Contributors to Wealth: Home Equity and Retirement Accounts by Jonathan Eggleston and Donald Hays (8/27/19), highlights gaps in wealth by household type.

Wealth inequality between homeowners and renters is striking: Homeowners’ median net worth is 80 times larger than renters’ median net worth.

In 2015, 37% of households did not own a home and 47.1% of households did not have a retirement account. This gap in two key assets contributes to wealth inequality.

The chart here comes from the report linked to in the note, New Worth of Households: 2015. For the “typical” household the home accounts for almost 35% of wealth. Two other statistics from the note:

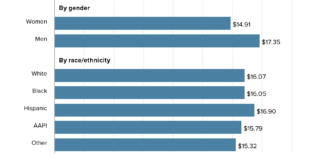

Non-Hispanic white and Asian householders had more household wealth than black and Hispanic householders. Non-Hispanic whites had a median household wealth of $139,300, compared with $12,780 for black householders and $19,990 for Hispanic householders. Asians had a median household wealth of $156,300, which is not statistically different from the estimate for non-Hispanic whites.

Higher education is associated with more wealth. Households in which the most educated member held a bachelor’s degree had a median wealth of $163,700, compared with $38,900 for households where the most educated member had a high school diploma.

The note links to Detailed Tables:2015 which provides extensive demographic information regarding wealth.