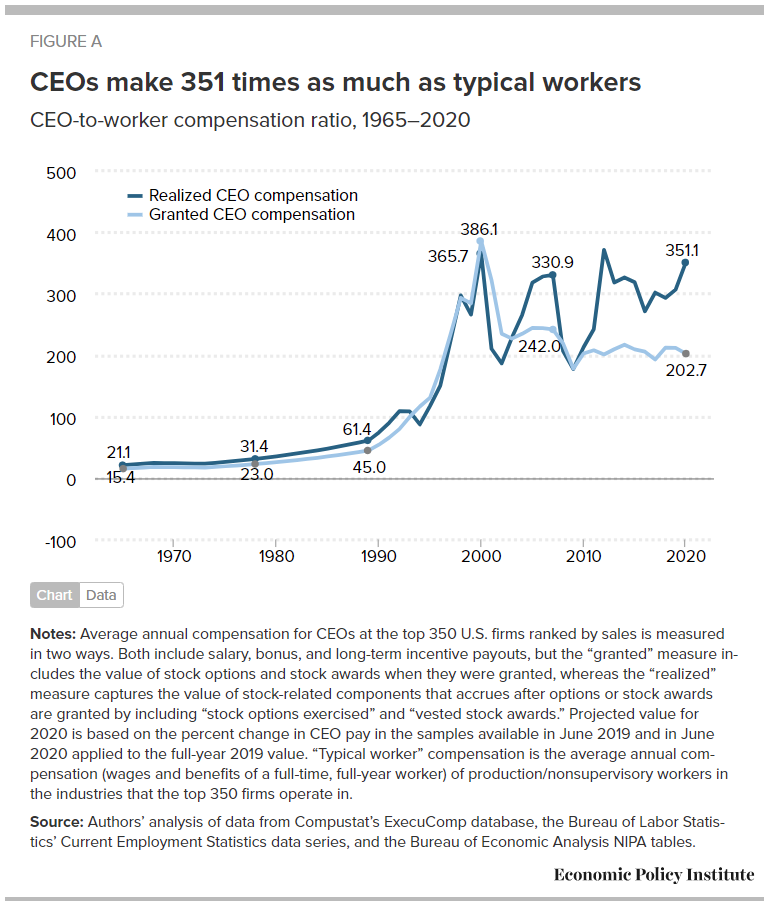

The Economic Policy Institute article CEO pay has skyrocketed 1,460% since 1978 by Josh Bivens and Jori Kandra (10/2/2022) include the chart here. Definitions first:

The Economic Policy Institute article CEO pay has skyrocketed 1,460% since 1978 by Josh Bivens and Jori Kandra (10/2/2022) include the chart here. Definitions first:

The realized measure of compensation includes the value of stock options as realized (i.e., exercised), capturing the change from when the options were granted to when the CEO invokes the options, usually after the stock price has risen and the options values have increased.

The granted measure of compensation values stock options and restricted stock awards by their “fair value” when granted. (Compustat estimates of the fair value of options and stock awards as granted are determined using the Black-Scholes model.)

CEO’s are doing better than the mere top 0.1%:

Over the last three decades, compensation grew far faster for CEOs than it did for other very highly paid workers (the top 0.1%, or those earning more than 99.9% of wage earners). CEO compensation in 2020 (the latest year for which data on top wage earners are available) was 6.88 times as high as wages of the top 0.1% of wage earners, a ratio 3.7 points greater than the 3.18-to-1 average CEO-to-top-0.1% ratio over the 1947–1979 period.

One outlier (he has the money to buy twitter I guess):

In 2021, Elon Musk (CEO of Tesla Motors) exercised $23.5 billion worth of stock options that would have expired in 2022. Under our “realized” methodology, this would have made his pay almost 1,000 times that of the average large-company CEO. Including him in our sample would have resulted in an increase of CEO pay in 2021 relative to 2020 of over 300% (the “average” for the sample would have been just under $100 million).

Because inclusion of this extreme outlier would have made this year’s numbers incomparable with previous years’ numbers, we opted to exclude Tesla and Musk from our sample entirely.

The article is excellent not just because of all the other graphs and access to data but they thoroughly explain their methodology.

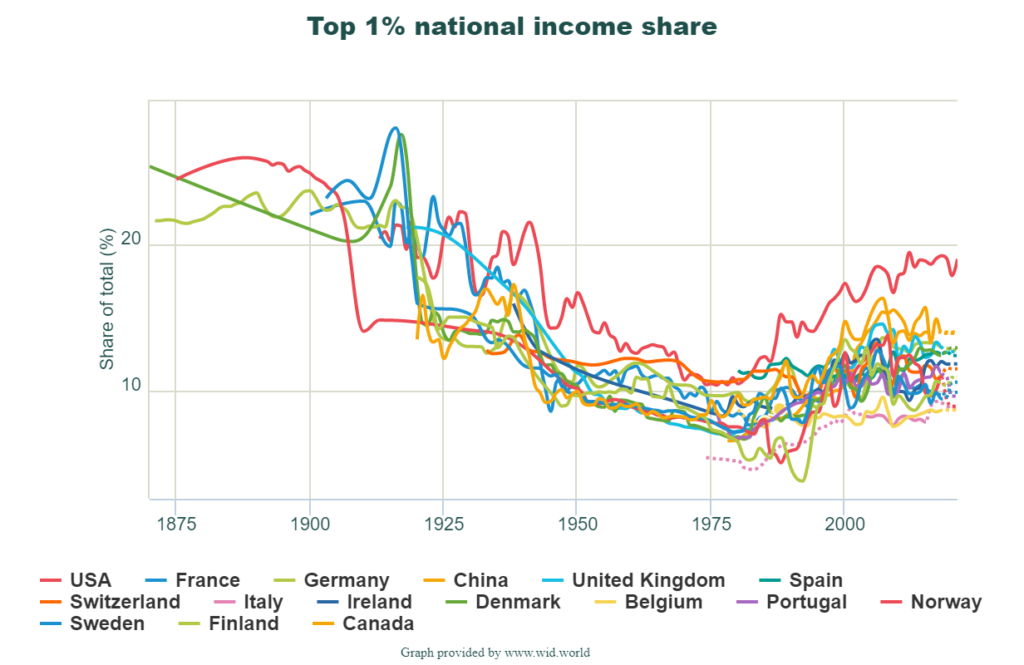

How we answer this questions depends on what we mean by best and the comparison group. For today we’ll look at the share of income by the top 1% and compare mostly western Europe countries. The graph here is from the world income database. It is good to be in the top 1% in the U.S. where they take home home 19% of the countries income in 2021. China is next at 14%. Note that this is a statement of the share of income and not what the income is.

How we answer this questions depends on what we mean by best and the comparison group. For today we’ll look at the share of income by the top 1% and compare mostly western Europe countries. The graph here is from the world income database. It is good to be in the top 1% in the U.S. where they take home home 19% of the countries income in 2021. China is next at 14%. Note that this is a statement of the share of income and not what the income is.