The iea report The Role of Critical Minerals in Clean Energy Transitions (May 2021) notes:

Alongside a wealth of detail on mineral demand prospects under different technology and policy assumptions, it examines whether today’s mineral investments can meet the needs of a swiftly changing energy sector. It considers the task ahead to promote responsible and sustainable development of mineral resources, and offers vital insights for policy makers, including six key IEA recommendations for a new, comprehensive approach to mineral security.

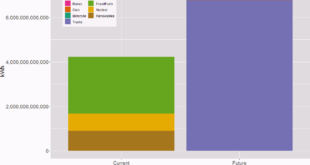

The executive summary has 11 charts that are all interesting. I chose the one here as it point out potential geopolitical changes. Generally speaking, countries with fossil fuels don’t seem to be the ones with the minerals.

One of the challenges:

Our analysis of the near-term outlook for supply presents a mixed picture. Some minerals such as lithium raw material and cobalt are expected to be in surplus in the near term, while lithium chemical, battery-grade nickel and key rare earth elements (e.g. neodymium, dysprosium) might face tight supply in the years ahead. However, looking further ahead in a scenario consistent with climate goals, expected supply from existing mines and projects under construction is estimated to meet only half of projected lithium and cobalt requirements and 80% of copper needs by 2030.

A great report that can certainly be used as the basis for quantitative discussion related to clean energy. If you click on the charts you can then download the related data.